Online NTN Verification in Pakistan – Everything You Need to Know

Published On 06 Jan, 2023

All governments require money, but the challenge is to select not only the appropriate tax rates, but also the appropriate tax base. Governments must also devise a tax compliance mechanism that does not dissuade people from taking part.

Thankfully, due to the steps of FBR, foreign Pakistanis who desire to get income tax exemption on ‘profit on debt’ received through remittances put in their domestic bank accounts will now have to present ‘exemption certificates’ to their respective banks.

In Pakistan, most folks don’t know their NTN number and if we go to study it we discover that NTN Stands for National Tax Number, and on the foundation of this NTN number we pay our tax consistent with our income, property, and so forth We need to know our NTN number when we have a documentation question, and we can ask our Finance Person, FBR, or SBR Department for it.

These days, the FBR department has made it quite simple to obtain your NTN number in Pakistan, as well as to check your NTN number and to obtain an NTN application form, all while sitting at home.Furthermore, the FBR has ruled out a further extension of the deadline for filing income tax forms. It has, however, enabled the chief commissions to accept requests for extensions after the deadline has passed. But let us first see what is FBR all about?

An overview of FBR

The Central Board of Revenue (CBR) was established on April 1, 1924, when the Central Board of Revenue Act of 1924 was passed. The Ministry of Finance established a full-fledged Revenue Division in 1944. Following independence, this system lasted until August 31, 1960, when the Administrative Reorganization Committee recommended that FBR be established an affiliated department of the Ministry of Finance.

Further adjustments to the organization and its tasks were implemented in 1974. As a result, the position of Chairman FBR was formed with the status of ex officio Additional Secretary, and the ex officio Chairman of the FBR, Secretary Finance, was relieved of his duties.

Its mission is to be a modern, progressive, effective, autonomous, and credible organisation that maximizes revenue by providing excellent service and promoting compliance with tax and related laws; and to improve the tax system’s ability to collect due taxes by employing cutting-edge technology, providing taxpayer assistance, and developing a motivated, satisfied, dedicated, and professional workforce.

FBR’s recent achievements

In a press release, the FBR stated that its efforts “to extend the tax base are progressing at a rapid rate.” Early indications suggest that such initiatives are paying off. Income tax returns for tax year 2020 have reached 2.8 million as of February 28, 2021, up from 2.6 million the previous year, representing an increase of 8%.

The tax deposited with returns was Rs.51 billion, up from Rs.33.0 billion the previous year, a 54 percent rise. Sales tax returns for the months of July 2020 to February 2021 were 179,584, up from 167,769 in the same period last year, representing a 7.04 percent rise.”

Some Additional information about NTN

The procedure of verifying an online NTN from the Federal Board of Revenue is known as online NTN verification. Depending on your need to validate online NTN, you can perform online NTN verification for a variety of reasons. The main grounds for substantiating online NTN are to confirm the Sole Proprietorship trade of anyone and to verify your individual NTN using your CNIC number.

For online NTN Verification, there are several elements to consider: CNIC, Passport Quantity, Corporation Registration Number, and Sales Tax Registration Quantity. You can also perform an online fbr ntn verification for businesses if you have a company registration option. ntn registration online verification can take anywhere from 2 to a few days to complete.

In addition to all applications submitted through the portal, online NTN will be applied manually. Check to see if you’re already enrolled in the FBR NTN log before applying for online NTN.FBR can enroll someone in online NTN; however, the individual who is being enrolled in online NTN is notified. The primary responsibility of the NTN holder is to file Federal Board of Revenue Earnings Tax returns on time.

Types of NTN

- Personal NTN: This kind is established by the FBR’s online NTN verification system and is issued on the person’s CNIC i.e ntn verification by cnic.

- Association of individuals: Individuals who are affiliated with each other can use this type of online NTN. Individual affiliation is defined as a three-person alliance. It is printed on the AOP’s registration certificates and verified using the FBR’s online strn ntn verification system.

- Partnership: The partnering firm receives this type of internet NTN. It’s printed on the Partnership agency’s registration certificates and can also be validated using FBR online NTN Verification system.

- Company’s NTN: This form of online NTN is available to the business. It is printed on registration certificates provided by Pakistan’s Securities and Trade Fee, and it is also validated through the FBR’s online NTN verification facility.

Update (Dec 04, 2020):

The Federal Board of Revenue (FBR) has set the deadline for filing income tax returns for the fiscal year 2019-2020 as December 8, 2020. So, if you haven’t already done so, make sure you log in to the FBR’s IRIS portal to finish the procedure.

The administration has also upgraded its Tax Asaan application to make it easier for citizens to file their wealth statement and verify their NTN online.

Why do tax rates and tax administration matter?

Governments require long-term sources of funding for social programs and public investments in order to promote economic growth and development. Health, education, infrastructure, and other services programs are critical to achieving the common aim of a successful, functional, and harmonious community. They also demand that governments increase income. Taxation is an important part of the social compact between citizens and the economy since it pays for public goods and services. The manner in which taxes are raised and spent can have a significant impact on a government’s legitimacy. Holding governments accountable promotes efficient tax administration and, more broadly, sound public financial management.

HOW IS ONLINE NTN VERIFICATION DONE IN PAKISTAN?

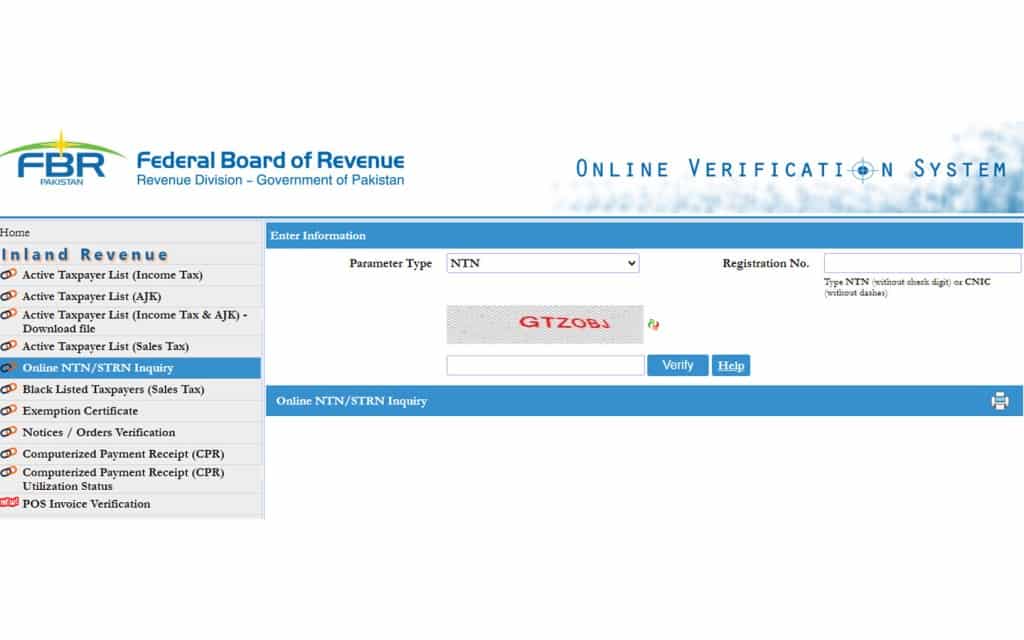

In Pakistan, obtaining an online NTN verification is pretty simple. You only need to go to the FBR’s website. On the left-hand side of the website, you’ll notice the ‘Online Services’ tab. Select ‘Online Verification Portal’ from the drop-down menu. You’ll be taken to the website for online verification services. Go to the NTN/STRN Inquiry tab on the website. You will be directed to the following page:

Choose NTN in the parameter box to get your online NTN verification. Fill in your National Tax Number without the dashes in the ‘Registration No.’ box. If you selected CNIC in the parameter box, then type your CNIC in the registration form – without the dashes. Now all you have to do is enter the captcha and click the Verify button, and you’re done! The following information will be provided to you:

- STRN

- Name

- Personal details (including cell number, email address and postal address)

- Date on which you registered as a taxpayer

- Tax office

- Status of registration

This is also called the online STRN verification or online verification for sales tax.

HOW TO ACCESS ONLINE VERIFICATION SERVICES THROUGH FBR’S TAX ASAAN APP

Tax Asaan is a smart mobile app that offers some of the same functions as the IRIS web app. The Federal Board of Revenue currently offers a variety of verification services to taxpayers (FBR). You can now view the Active Taxpayers’ List and make an NTN Inquiry or an online STRN Inquiry through the FBR’s Tax Asaan App, in addition to making e-payments or going through the simplified procedure of sales tax registration for enterprises.

You can also check the status of the Exemption Certificate and the CPR Utilization. Let’s get started on how to use the Tax Asaan App’s online verification services for taxpayers.

In this blog, we’ll walk you through the new Tax Asaan App from the Federal Board of Revenue, which is transforming Pakistan’s tax system. The government is also taking steps to modernise the process of filing tax returns with the Tax Asaan App, which will provide taxpayers with on-the-go access to e-returns.

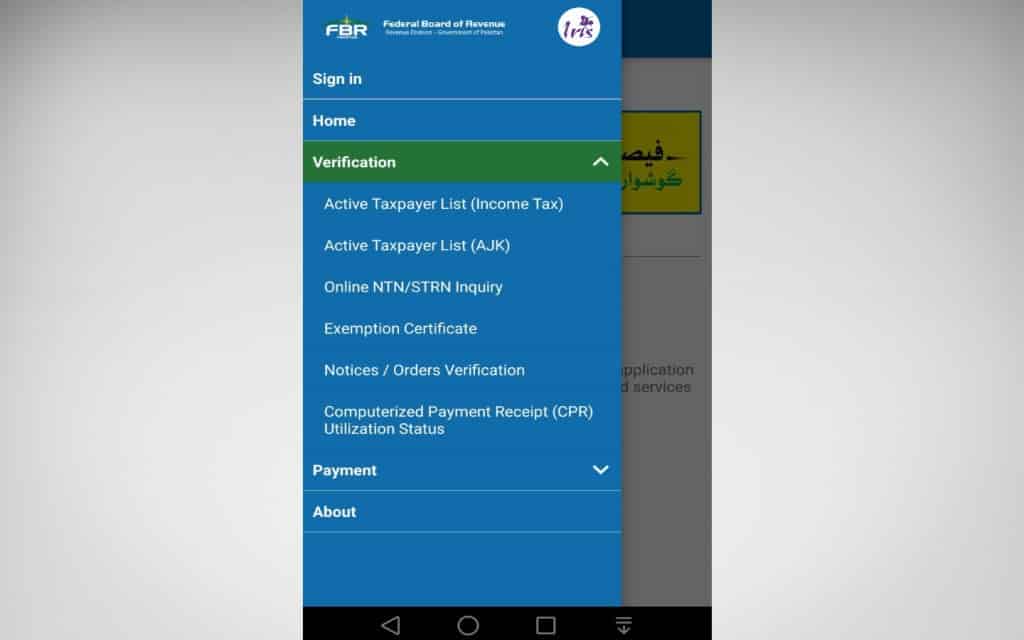

FBR’s Tax Asaan App is available on the Google Play Store. Open the Tax Asaan application. The main menu will appear. You must first sign into your account before proceeding to the main menu. After logging in, select the Verification Tab to reveal a drop-down menu with the following sub-options.

- Active Taxpayer List (ATL)

- Online NTN/STRN Inquiry

- Exemption Certificate

- Notices and Orders Verification

- Computerized Payment Receipt (CPR) Utilization Status

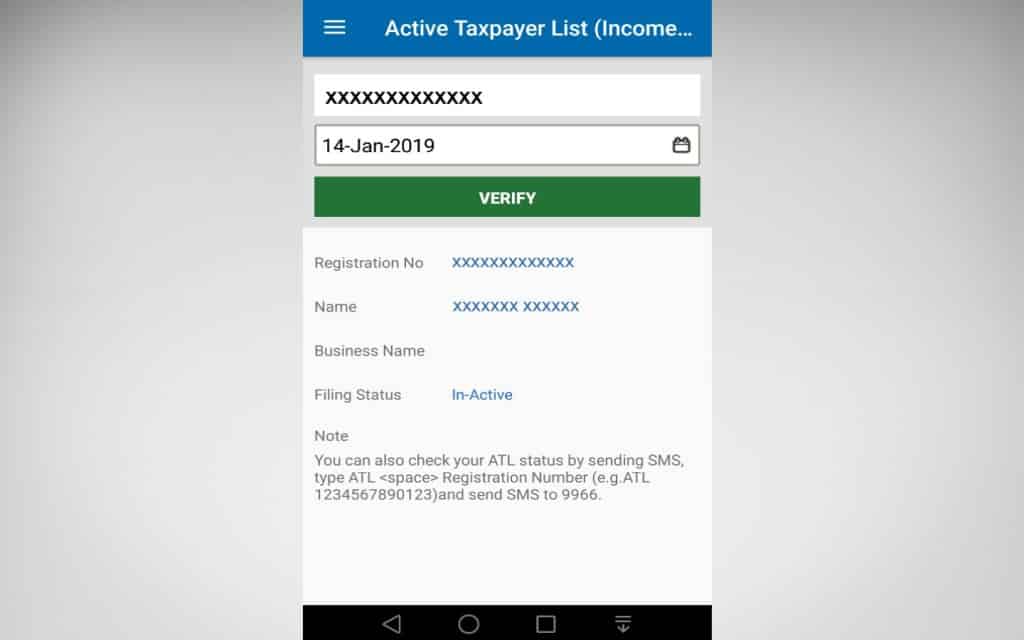

HOW TO VERIFY YOUR NAME IN THE ACTIVE TAXPAYER’S LIST (ATL) AFTER FILING INCOME TAX RETURNS

Checking your taxpayer status is now much easier. With the click of a mouse, the status of taxpayers may now be verified. To use the Tax Asaan App’s online verification services, go to the Active Taxpayer List tab and click on it.

The user is taken to the ATL verification page. Without leaving any spaces or using any dashes, enter the Registration Number, which is the 7-digit National Tax Number or NTN. Alternatively, you can type your CNIC Number without any dashes. By clicking on the calendar icon, you can select a certain date. To check your taxpayer status, click the Verify button.

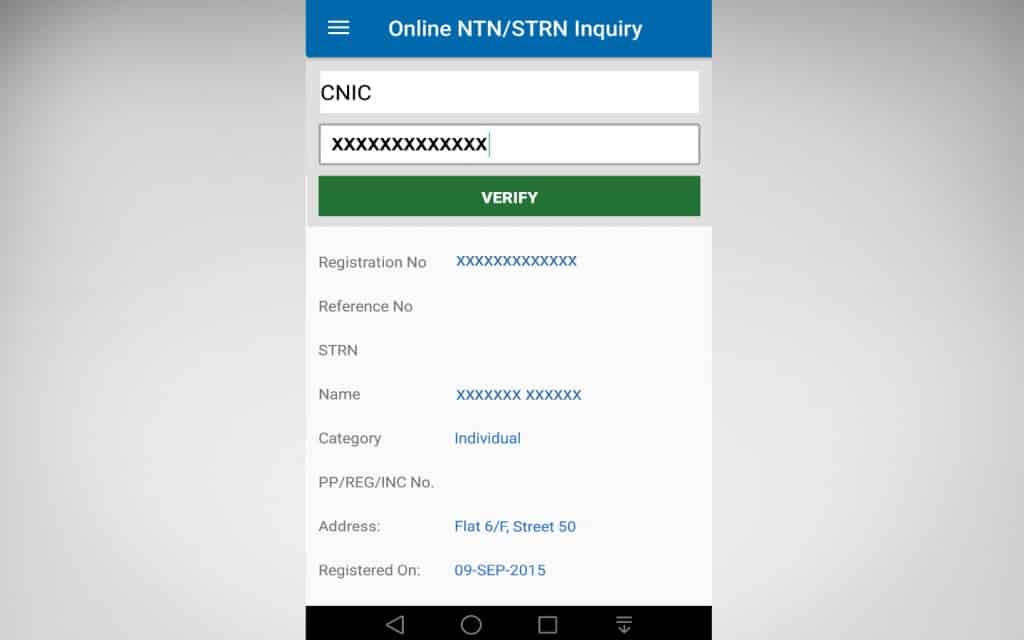

HOW TO GET ONLINE NTN/STRN INQUIRY VIA TAX ASAAN APP

You can find out everything you need to know about your National Tax Number (NTN), Sales Tax Registration Number (STRN), Computerized National Identity Card Number (CNIC), and even your passport number.

To use the Tax Asaan App’s online verification services, go to the Verification Tab and select Online NTN/STRN Inquiry. If you want information on your CNIC, type in your CNIC number. When you click the Verify button, you’ll see all of the information about your CNIC, including your name, address, and the date it was issued.

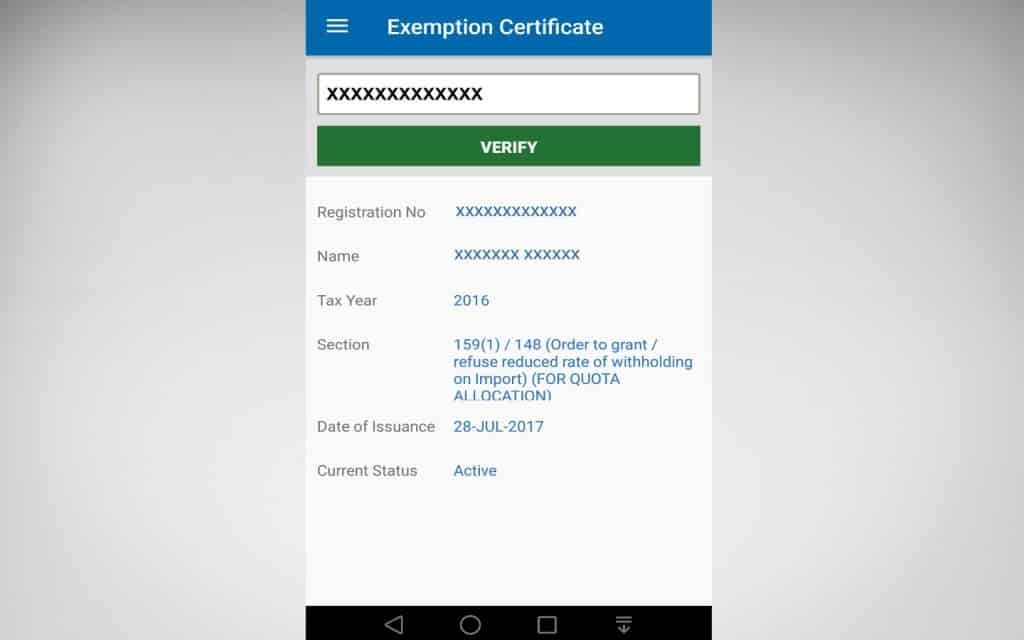

HOW TO GET INFORMATION ABOUT EXEMPTION CERTIFICATES VIA TAX ASAAN APP

The specifics of any tax exemptions you’ve received from FBR are also available on the app. All you have to do now is go to the Verification Link and click on the Exemption Certificates tab. You will be redirected to the appropriate landing page by the smart programme. Fill in the blanks with the ‘Bar Code Reference.’ To acquire all of the information, use the verify button. You will receive information such as your name, registration number, tax year, exemption certificate section, date of issuance, and whether or not it is still valid.

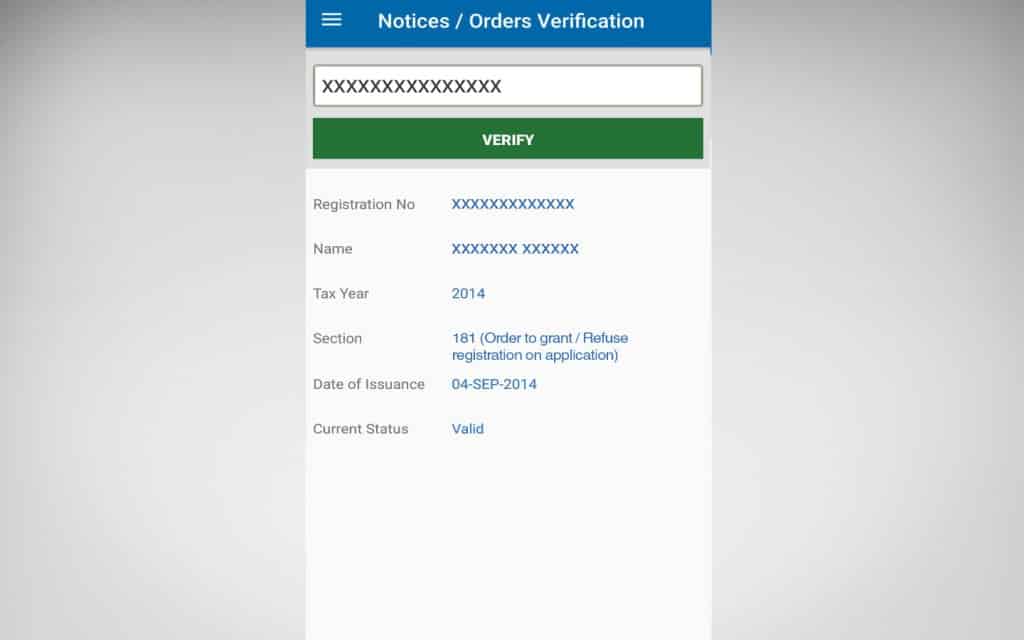

HOW TO GET NOTICES/ORDERS INFORMATION VIA TAX ASAAN APP

HOW TO GET NOTICES/ORDERS INFORMATION VIA TAX ASAAN APP

Follow these methods to receive all kinds of information for any notices or orders issued by FBR. The user will be taken to the appropriate page after clicking the Notices and Orders Verification Tab under the Verification button. In the field provided, type the Order Reference Number. After that, click the Verify button. On the screen, you’ll see all of the details and status of the provided notice.

HOW TO GET COMPUTERIZED PAYMENT RECEIPT I.E CPR UTILIZATION STATUS VIA TAX ASAAN APP

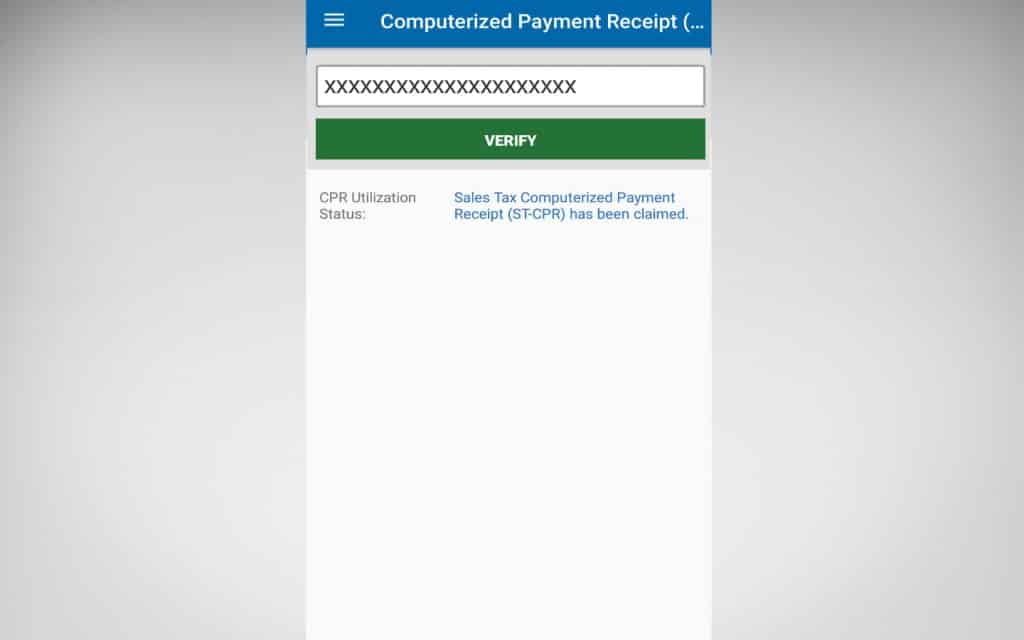

The online verification capabilities provided by the Tax Asaan App are also intended to verify whether the CPR mentioned was used to pay any taxes. This is how you may find out if CPR is still working. It’s also known as the CPR verification through FBR.

Under the Verification Tab, select Computerized Utilization Status. The app will be forwarded to the appropriate page. Enter the CPR number in the supplied field. The CPR Utilization Status will appear when you click the verify button. So, if you have claimed your Sales Tax Computerized Payment Receipt (ST-CPR), it will appear as in the image above.

BENEFITS OF GETTING AN NTN

- Obtaining an NTN entitles you to file income taxes with the Internal Revenue Service.

- By displaying his National Tax Number, a businessperson might gain a variety of advantages.

- Those with an NTN number are seen as more trustworthy.

- It also demonstrates that you pay your taxes on time and are patriotic to your country.

- You can join several society clubs as an elite member by displaying your NTN.

- You can also use your NTN to participate in government auctions and negotiate contracts with the government.

- Members of chambers of commerce and industry can join if they have an NTN.

- Foreign visas are easy to obtain for those who pay their taxes on time and have a valid NTN.

Taxes and fees are an important source of public revenue for governments, allowing them to pay investments in human resources, infrastructure, and the provision of services to citizens and enterprises. When you register your NTN number, you become a taxpayer. The current administration is also harsh on non-taxpayers. By registering, you put yourself in the limelight for the perks and advantages that the majority of taxpayers are entitled to.